The Save4College State Contribution Program is now accepting applications. You may be eligible for a $250 or $500 contribution. Apply by May 31!

Learn MoreTHE BENEFITS OF OUR PLAN

Why Save with the Maryland College Investment Plan?

Your child has big dreams about a future where they can be anything they want to be. A Maryland College Investment Plan account is flexible to help them pursue those dreams.

Available to All—Open an account for anyone at any time. You could be a new parent or a grandparent, but you don't need to be related to the beneficiary, and residency in Maryland is not required. You can even open an account for yourself. There are no age or income restrictions for beneficiaries.

Affordability—Save for education your way. Choose how much and how often you want to invest based on your budget and goals. You can open an account starting with as little as $25.

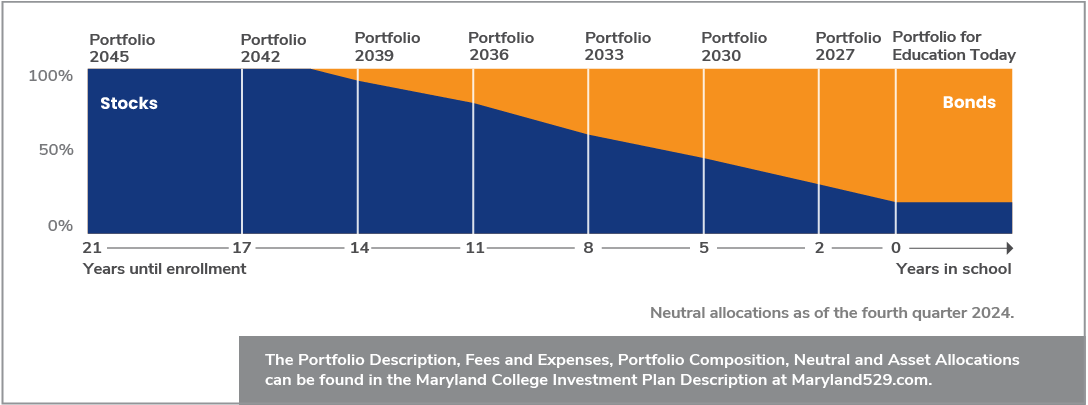

Investment Options—Choose from a variety of investment options according to your investment comfort level and the number of years until you will first use your savings. Our historical portfolio performance is updated daily to show you the up-to-date standardized total returns of our investments.

Flexibility—Any earnings are Maryland and federally tax-free1 when used for qualified education expenses throughout the U.S. at nearly any public/private college, trade/technical school, and registered apprenticeship program—or even at some international universities.

Gifting—Invite friends and family to be a part of your savings journey by gifting with a Ugift® code that links directly to your account.

Owner Managed—With some exceptions, account owners, rather than the beneficiaries, maintain control of the funds in the account even if plans change.

State Contribution Program—You could be eligible to receive a $250 or $500 contribution from the State of Maryland through the Save4College State Contribution Program.

Tax Benefits—Your contributions may be eligible for a State income subtraction for Maryland taxpayers on contributions of up to $2,500 per beneficiary each year.

YOUR SAVINGS JOURNEY

We're Here to Guide You Along the Way

As a Maryland College Investment Plan account owner, we’ll be with you every step of the way throughout your education savings journey. We have tools and content designed to help you when you need it most, whether you have a newborn baby or your child is already a teenager.

250,000 Families

Over a quarter of a million families helped invest in a brighter future

$10 Billion

Over $10 billion in assets under our management

375,000 Accounts

There are more than 375,000 Investment Plan accounts

Investment options

Choose a Target Year Portfolio or DIY. You Have Options.

Choose the investment option that best meets your goals. We've got options – you can save for education your way.

Morningstar, Inc., “Silver” Rating

The Maryland College Investment Plan was one of only 13 plans to receive a "Silver" rating by Morningstar, Inc. in 2025.

Silver-rated 529 plans sport a combination of superior investment teams, robust investment processes, and/or good state stewardship that benefits participants.2

Top 10 Performance

The Maryland College Investment Plan was ranked #3 for 529 plan enrollment-based portfolio performance in the ten-year period, #2 in the five-year period, and #2 in the three-year period as of 9/30/25.

Saving For College conducts quarterly evaluations of the investment performance of thousands of 529 enrollment-based portfolios and ranks the plans based on the results.3 According to Saving For College, the rankings are "…a helpful tool for families and financial professionals looking to compare college savings options."

Saving For College has been the leading independent authority on 529 savings plans since 1999. The site compiles and analyzes data and creates content and tools to provide parents, financial professionals, and state policymakers with resources to help them understand how to meet the challenge of ever-increasing education costs.

2025 “Top of the Class” Award

The Maryland College Investment Plan earned the “Top of the Class” designation from Saving for College in their 2025 529 Ratings, placing it among only 8 direct-sold 529 plans recognized.4 This award signifies that these plans have outperformed more than 80% of their peers in the category.

OPENING AN ACCOUNT

How to Open a Maryland College Investment Plan Account

Take the first step on your education savings journey today.

Open a College Investment Plan Account

With the College Investment Plan managed by T. Rowe Price, an investment management firm with more than 80 years of experience, you can save for your child’s future education on your terms.

Choose an Investment Option

We offer a variety of investment options whether you are new to investing or prefer a hands-on approach.

Contribute All at Once or Save Regularly

Once you open an account, you can tailor your contributions to your current budget. It’s easy to save with a one-time contribution or recurring contributions with the option of increasing over time.

Recurring ContributionsPLAN TOOLS & RESOURCES

The Maryland College Investment Plan offers the following additional features, tools, and resources.

Boost Their Future With Ugift®

Friends and family can join in the excitement, contributing to your child’s educational future with Ugift. All gifts that are invested into your child’s College Investment Plan account are intended to be used for qualified education expenses.

Visualize Their Future

The College Financing Planner provides customized projections to estimate your future college expenses. Use this tool to create a savings plan to achieve your college funding goals.

1 There may be tax implications for Maryland taxpayers who take a distribution for the education loan of a sibling of the beneficiary. Maryland 529 cannot and does not provide tax advice. Your tax consequences depend on your individual circumstances. If you withdraw funds that are not used for qualified education expenses, any earnings on that distribution may be subject to income taxes and a 10% federal penalty. In addition, there may be Maryland tax consequences for your contributions. State tax laws and treatment may vary. So, check with a tax professional regarding your specific situation.

2 Morningstar analysts reviewed 59 plans for its 2025 ratings (11/10/25), of which 13 plans received a "Silver" rating. To determine a plan's rating, Morningstar's analysts organized their research around 4 key pillars: Process, People, Parent, and Price. Plans were then assigned forward-looking ratings of "Gold," "Silver," "Bronze," "Neutral," and "Negative." Each year, certain of the industry's smallest plans are not rated. Click here for additional information about Morningstar's methodology.

Analyst Ratings are subjective in nature and should not be used as the sole basis for investment decisions. Analyst Ratings are based on Morningstar analysts' current expectations about future events and, therefore, involve unknown risks and uncertainties that may cause Morningstar's expectations not to occur or to differ significantly from what was expected. Morningstar does not represent its Analyst Ratings to be guarantees.

©2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

3 Each quarter, Saving For College analyzes the investment performance figures for thousands of 529 portfolios, comparing the reported investment performance of a subset of portfolios from each 529 savings plan to produce their rankings. As of 9/30/25, the rankings for the Maryland College Investment Plan were: 3 out of 23, 2 out of 43, 2 out of 50, and 18 out of 53 for the 10-, 5-, 3-, and 1-year periods, respectively. Saving For College compares historical investment returns for all enrollment-based portfolios, including age-based and year-of-enrollment portfolios, within a given age band from 0 to 19+. A hypothetical average annual return is then calculated for each plan's enrollment-based portfolios along a glide path from 0 to 19+, and the plans are ranked from highest to lowest return. There are separate comparisons for direct-sold and advisor-sold plans. More information about the methodology and the performance rankings can be found on savingforcollege.com.

4Saving for College evaluated a total of 85 state-sponsored 529 savings programs for its 2025 Ratings: 55 direct-sold programs and 30 advisor-sold programs. Top of the Class designation was awarded to less than 20% of the evaluated programs in each category. Visit this page for more information on the criteria used in compiling a plans's 529 rating. The factors Saving For College examined and scored for each 529 plan are grouped into four categories: Performance, Ease of Use, Savings Success, and Program Delivery. A plan's four individual category scores are computed on a scale of 1 to 5 and carried out to two decimal places. The overall 529 Rating is a weighted average of these four category scores.

Ugift® is a registered service mark of Ascensus Broker Dealer Services, LLC.

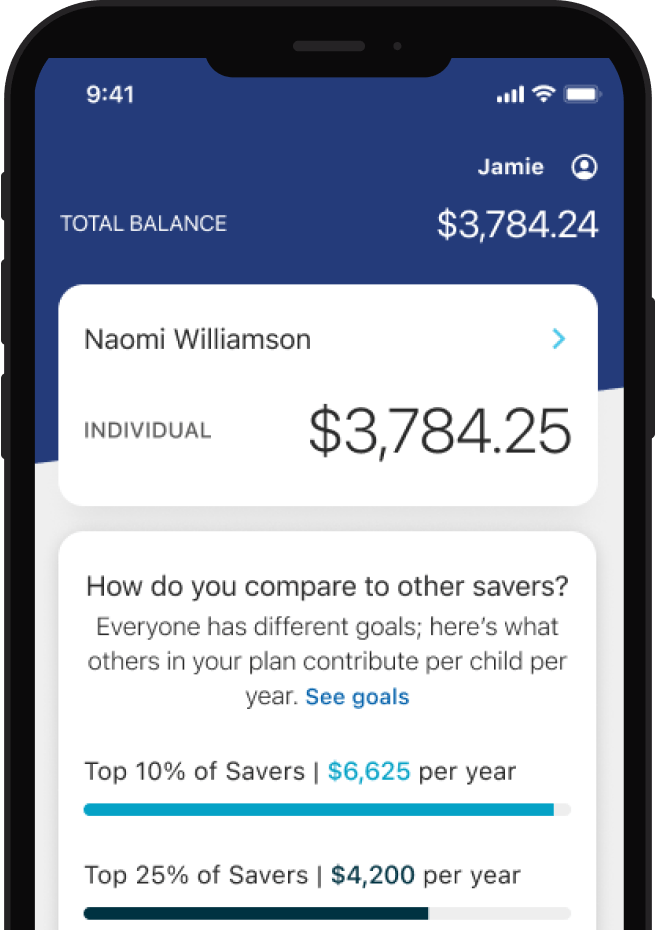

Regularly monitor your account

Check your account balance, transaction history, and investment allocations.

Contribute at your pace

Add money to your balance as a one-time or recurring contribution.

Gifting from friends and family

Easily invite friends and family to help give your savings a boost with Ugift®.

The Save4College State Contribution Program is Now Accepting Applications for 2026!

Open a Maryland College Investment Plan account and apply by May 31.