Why Save early?

Saving now can help make a big difference later.

Give your child a head start on their college savings with as little as $25. The more you are able to save today with a 529 account, means the less you may have to borrow tomorrow.

Learn MoreInvestment options

Save for education your way.

We offer a variety of investment options whether you are new to investing or prefer a hands on approach.

STATE contribution program

Receive Up to $500 With the Maryland Save4College State Contribution Program.

The Save4College State Contribution Program is designed to help lower to middle-income households in Maryland save money for higher education.

Learn moreRegularly monitor your account

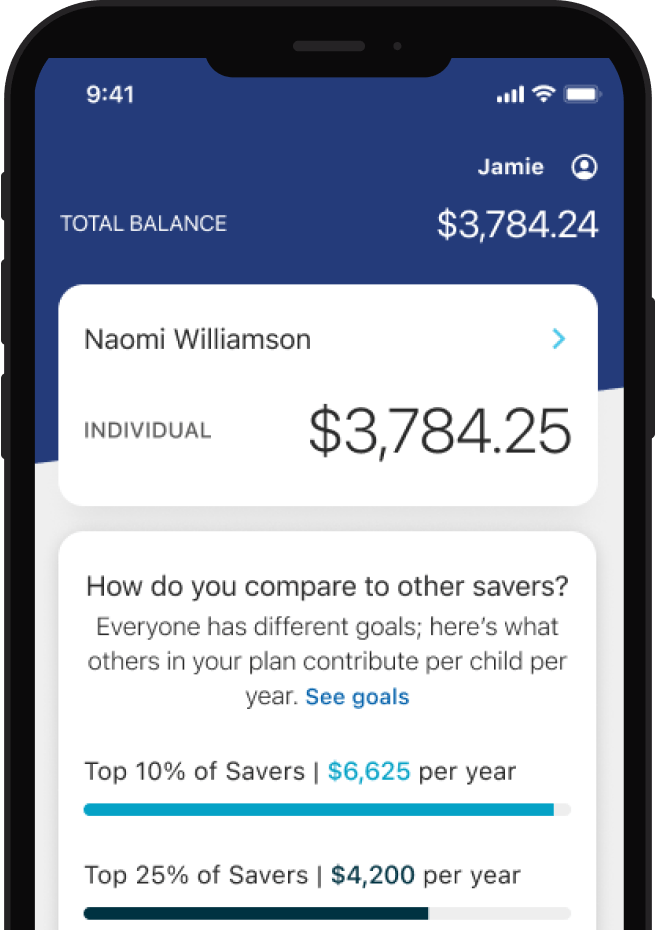

Check your account balance, transaction history, and investment allocations.

Contribute at your pace

Add money to your balance as a one-time or recurring contribution.

Gifting from friends and family

Easily invite friends and family to help give your savings a boost with Ugift®.

Programs

Maryland 529 programs

Information for Maryland ABLE and Maryland Prepaid College Trust.

Maryland ABLE

Maryland ABLE accounts are a new way to help individuals with disabilities save money and pay for Qualified Disability Expenses without jeopardizing State or federal means-tested benefits such as SSI or Medicaid.

Learn MorePrepaid College Trust

The Prepaid College Trust is closed to new enrollments. Current Account Holders can log in to their account and access plan information below.