Gifting

For Account Owners

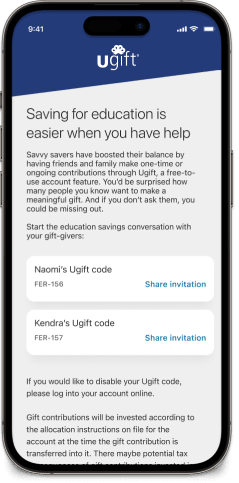

Gift givers have an opportunity to give a gift that will last a lifetime: the gift of education. Friends and family can give a contribution in lieu of gifts any time of the year—birthdays, holidays, or just because.

-

To access Ugift® and your beneficiary's unique Ugift code, simply log in or download the ReadySave™ 529 mobile app.

-

Easily share your secure code via email, text, and social channels, or include it on evites and printed invitations.

-

Automatically track gifts received: Log in to your account and click Ugift. Go to "View Ugift history" to find gift activity, including the name of the gift giver (if provided), the amount of the gift, and the gift's status.

-

No fees. Neither the College Investment Plan account owner nor the gift giver has to pay any fees for using Ugift. The entire amount of the gift will be deposited into the account.

Download the READYSAVE™ 529 mobile app today

Did you know that making a gift to a Maryland 529 account offers a unique Maryland State income subtraction?

Maryland taxpayers are eligible for an annual Maryland State income subtraction on contributions of up to $2,500 per account, or per beneficiary, depending on what plan you choose—even if it's not your own.

For Gift Givers

You can conveniently send a gift by secure electronic transfer using a unique Ugift code or by mail. All funds will go directly into the beneficiary's College Investment Plan account.

-

Ask the Maryland College Investment Plan account owner to send you a secure code to the gift recipient’s profile. With the beneficiary’s Ugift code, making a gift contribution is simple and easy.

-

Set up a gifting profile so that you can easily send recurring gifts.

-

Another gifting option to consider is to Open an Account for the gift recipient. Learn More about the Maryland College Investment Plan.

If you're looking to contribute a gift with a check, ask the account owner to send you a secure code to the gift recipient's profile. Follow the instructions. You will not have to create a gifting profile. Simply select the option to download the form that will be prefilled with the account owner and beneficiary name to mail in your check. You can also send in contributions at any time by check if you are not using Ugift.

-

Make the check payable to Ugift—Maryland College Investment Plan.

-

The account number must be included with the contribution so that it's linked to the correct account.

-

Include a note with your name so that when the account owner views their 529 account online, your name will display next to the amount of your gift.

-

Checks should be mailed to:

Ugift - Maryland College Investment Plan

PO BOX 55913

Boston, MA 02205-5913

Ugift® is a registered service mark of Ascensus Broker Dealer Services, LLC.