Growth Potential

Get More From Your Savings

Saving for college or other higher education can be a big financial challenge for many families. A 529 plan is a powerful tool that parents can utilize to bridge the affordability gap and help secure their children’s educational future. It offers the potential of higher returns and tax-advantaged growth compared with lower-yielding bank accounts.*

In addition to any growth being tax-deferred, the Maryland College Investment Plan offers Maryland tax payers an annual State income subtraction on contributions of up to $2,500 per College Investment Plan beneficiary.

Distributions used to pay for qualified education expenses are free from federal and state taxes, helping you keep more of your savings.

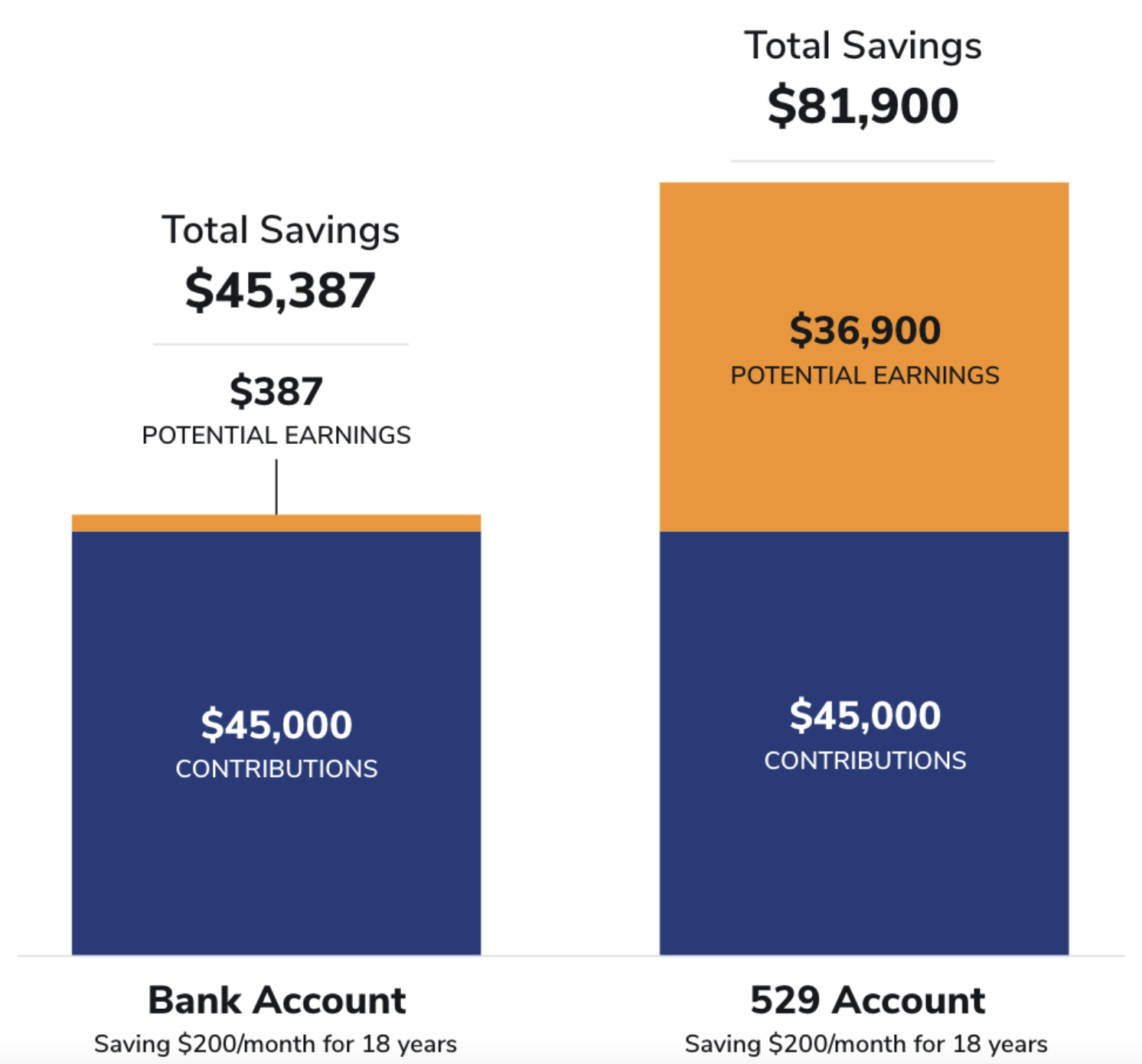

Saving in a Bank Account vs. a 529 Account

ADVANTAGE OF STARTING TO SAVE EARLIER

Get a Head Start on Their Future, Your Way.

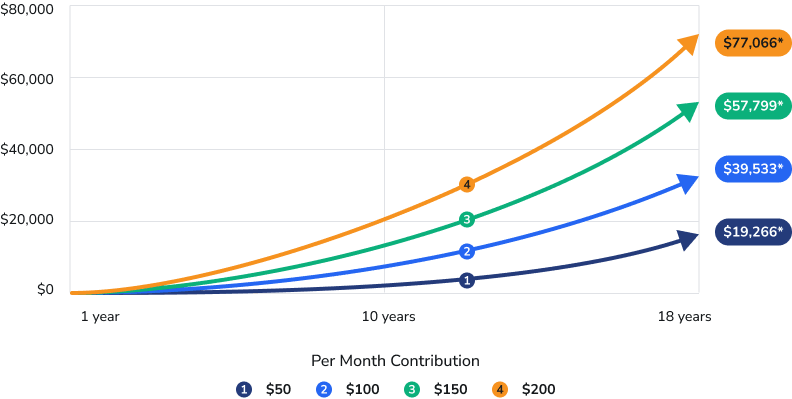

It’s never too late to start saving for your child’s college, but the earlier you start, the better. Every contribution can add up. The more you are able to save today, means the less you may have to borrow tomorrow.

Learn About Recurring ContributionsChart assumes a hypothetical 6% rate of return compounded monthly and monthly contributions made at the end of each month. This chart is for illustrative purposes and does not represent the return of any specific investment options. Investment returns in a college savings plan will vary and may be higher or lower than this example. This illustration does not include fees, and any fees assessed by the investment offering could have an impact on returns.

This chart shows the potential growth of contributing different amounts monthly over time.

T. Rowe Price Insights

Closing the College Affordability Gap: Maximizing the Benefits of 529 Plans

While juggling so many competing priorities, saving for higher education can be a big financial challenge for many families. Inflation has taken a toll on many household budgets, and finding money to set aside to save for future education has understandably become increasingly challenging.

Roger Young, CFP®, a T. Rowe Price thought leadership director, provides insight on how 529 plans can be a powerful tool that parents can use to bridge the college affordability gap without relying too heavily on loans and to help secure their children’s educational future.

Learn More*Unlike a traditional bank account that offers Federal Deposit Insurance Corporation protection, investments in 529 plans are generally not guaranteed, and you could lose money, including your principal, by investing in them. There may be other material differences between savings accounts and 529 college savings plan accounts that should be considered prior to investing.

**This representation demonstrates the difference between hypothetical rate of return in a bank account and a 529 college savings plan account, compounded monthly, but not between any two specific products. This example doesn’t represent the return on any particular investment, and these rates are not guaranteed.