Requesting A Distribution

You can quickly and securely take a distribution whenever you are ready.

You can request a distribution at any time and receive your money between two and ten business days, depending on which method of distribution you choose.

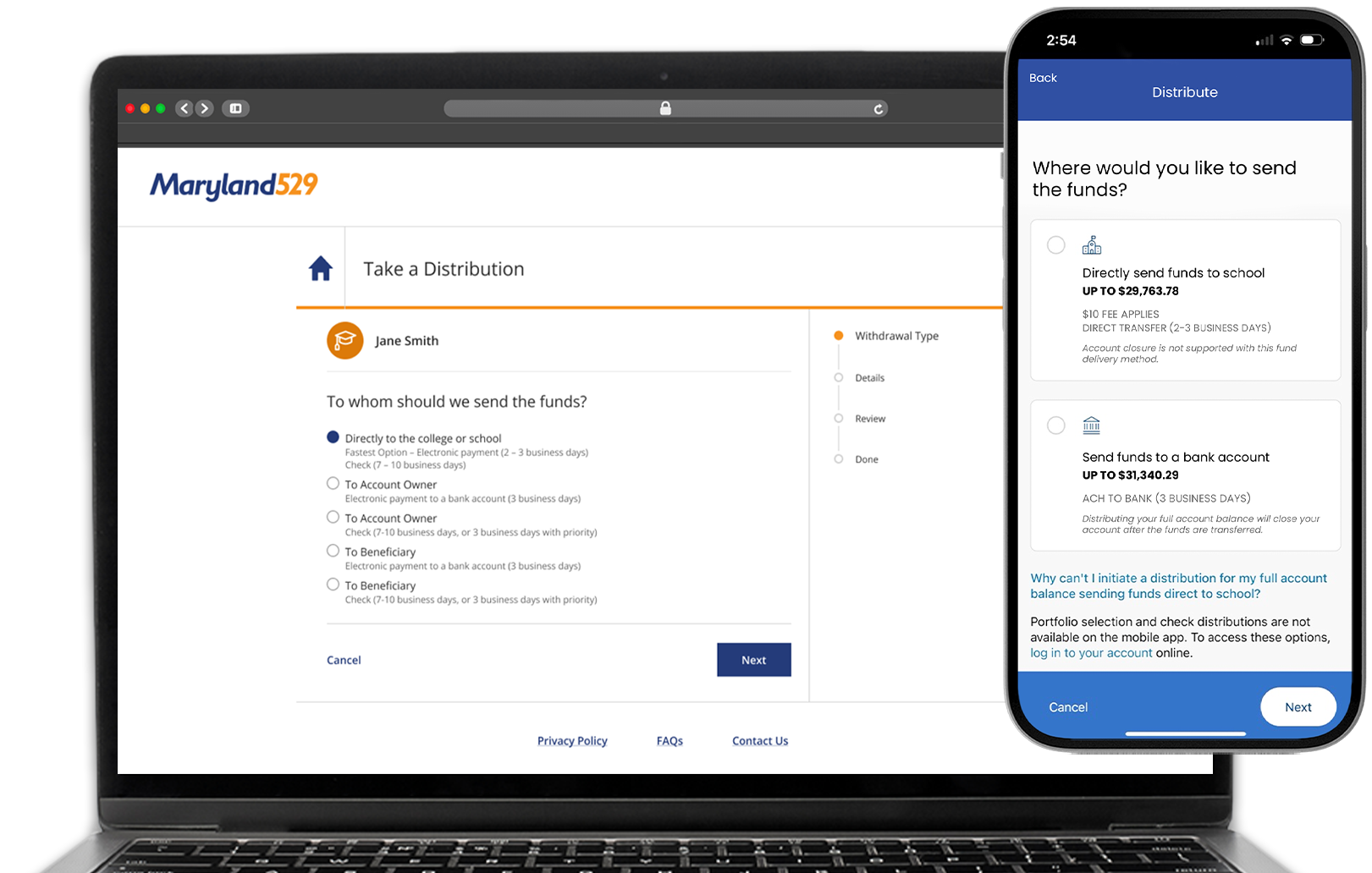

Options for Distributions

Your money, your way.

The Maryland College Investment Plan has multiple options for you to take a distribution.

Be sure you have the following information handy:

- Your Investment Plan login information

- The beneficiary from whose account you want to make a withdrawal

- The amount you want to withdraw

- For direct to school transfers: the beneficiary's student ID number associated with their school

Send directly to a participating school

Your online account and the READYSAVE™ 529 mobile app offer a convenient and efficient way to send your savings directly to a school electronically. This is the fastest option to get funds to a school.

$10 fee applies to direct to school transfers

Electronic transfers to a bank account

You can transfer funds from your online account or the READYSAVE™ 529 mobile app to your or beneficiary's bank account, which offers the benefits of quick distribution processing and enhanced security.

Send a check

If you prefer, your online account offers the flexibility to send funds via check to you or your beneficiary.

learn more about distributions

Distributions FAQs

You will have the option to:

- Send electronic payments directly to participating colleges, universities, and other eligible postsecondary schools* from your online account or mobile app.

- Request a check to be sent directly to colleges, universities, and other eligible postsecondary schools*from your online account.

- Send funds electronically to your existing bank account on file from your online account or the mobile app.

- Request a check made payable to yourself to be sent to your address on record from your online account.

- Send funds electronically to the beneficiary's existing bank account on file from your online account or the mobile app.

- Request a check made payable to the beneficiary to be sent to the beneficiary's address on record from your online account.

Any distribution request of $100,000 or more requires the Distribution Request Form and will also require a Medallion Signature Guarantee.

It is important to note that tax reporting is dependent upon the payee of the distribution. If the distribution is made payable to the account owner, the tax reporting will be issued under the account owner's Social Security number and mailed to the account owner's address on file. If the distribution is payable to the beneficiary or an eligible postsecondary school, the distribution will be reported under the beneficiary's Social Security number and the tax form will be mailed to the beneficiary's address on file.

*If an electronic payment or a check is sent directly to the school, the beneficiary will be the taxable party for the distribution and will receive a 1099-Q for the current tax year. Please note that distribution checks for K-12 schools should be made payable to the account owner or the beneficiary.

We do our best to give you access to your distribution as quickly as possible.

Distribution requests received in good order are processed the day they are received if they are received prior to 4:00 pm ET on a business day. If the request is received after 4:00 pm ET or on a holiday, weekend, or other non-business day, the request will be processed the following business day.

The quickest way to distribute funds to a school is to request an online electronic payment directly to a postsecondary school. This request typically takes two business days.

Alternatively, you can request an online electronic payment to a bank account on file for you or your beneficiary. This option typically takes three business days.

Finally, you can request a check payable to yourself, your beneficiary, or a postsecondary school. Checks typically take 7 to 10 business days to be received in the mail, after the distribution request has been processed by the Investment Plan.

You can use the funds in your 529 account to pay for qualified education expenses as defined in the Internal Revenue Code.

For the distributions to be federally tax-free, visit our Approved Uses tool for a detailed overview of the options available.

If you withdraw funds that are not used for qualified education expenses, any earnings on that distribution may be subject to income taxes and a 10% federal penalty.

No, you are responsible for satisfying the IRS requirements for proof of a qualified distribution, which include retaining any paperwork and receipts necessary to verify the type of distribution you receive.

Each January, the Maryland College Investment Plan issues Form 1099-Q for any distributions taken during the previous calendar year. This form is mailed to the account owner if the distributed assets were mailed or electronically sent to the account owner. If the assets were sent to the beneficiary or the eligible postsecondary school, then the 1099-Q is mailed to the beneficiary's address on file. The account owner can access any account owner 1099-Qs online by logging in to their account online and clicking Profile & Documents from their dashboard.

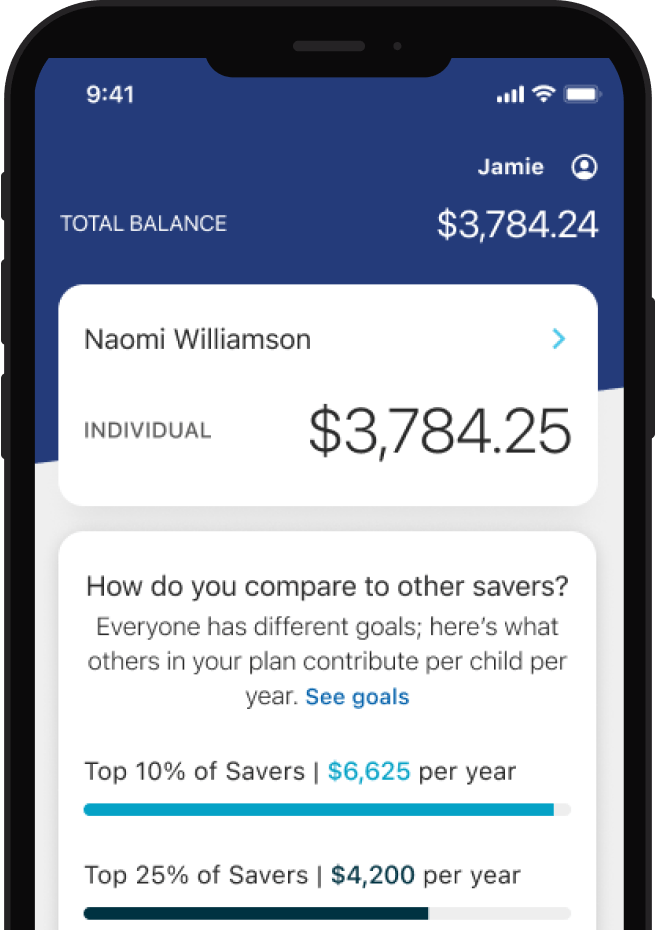

Regularly monitor your account

Check your account balance, transaction history, and investment allocations.

Contribute at your pace

Add money to your balance as a one-time or recurring contribution.

Gifting from friends and family

Easily invite friends and family to help give your savings a boost with Ugift®.